|

Production Profile and Cash Flow

Production Profile and Cash Flow

To calculate

a cash flow estimate for a well or a pool, we need a

production profile from actual well performance or a decline

curve analysis run at equal time increments. It is easiest to generate a monthly flow rate, monthly income,

and monthly expense table, based on the following equations. The

annual decline rate D can be found by

decline curve analysis or from

the simpler production projection /

economic life models elsewhere in this Handbook.

Cash Flow Analysis

Cash Flow Analysis

Monthly production decline rate:

1: Dp = (1 + D) ^ (1 / 12) - 1

This number must be negative for all real wells.

Monthly price escalation rate.

2: Epr = (1 + EP) ^ (1 / 12) - 1

Monthly expense escalation rate.

3: Eex = (1 + EE) ^ (1 / 12) - 1

Monthly discount rate on money.

4: Dmo = (1 + DM) ^ (1 / 12) - 1

Next, calculate the production and net revenue for the constant

and declining rate portion of the well life. For each month from

the beginning of production to the end of the production, calculate

the following:

5: FOR T = 1 TO Tec

Monthly production at constant rate.

6: IF T <= Tcon

7: THEN Qm = QI * 365 / 12

Monthly production at declining rate.

8: IF T > Tcon

9: THEN Qm = QI * 365 / 12 * ((1 - Dp) ^ (T - Tc))

Monthly gross operating income.

10: GROSSinc = (1 - ORR - ROY) * Qm * Pr * ((1 + Epr) ^ T)

Monthly fixed operating cost.

11: FIXEDcost = COP * ((1 + Eex) ^ T)

Monthly lifting cost.

12: LIFTcost = CLF * Qm * ((1 + Eex) ^ T)

Monthly net operating income.

13: NETinc = GROSSinc - FIXEDcost - LIFTcost

Discounted cash flow.

14: Dcf = NETinc * ((1 + Dmo) ^ T)

Return to working interest.

15: Rwi = WI * DCF

16: END LOOP

To

obtain the total present value of the well, the individual monthly

discounted cash flow must be summed over the life of the well.

Present

value of well.

17: PVtotal = SUM (Dcf) - DCC

Present value of well to working interest.

18: PVwi = WI * PVtotal

Where:

CLF = lifting cost ($/unit prod)

COP = monthly operating cost ($/unit prod)

D = annual production decline rate (fractional)

DCC = drilling and completion cost (dollars)

Dcf = monthly discounted cash flow (dollars)

DM = annual discount rate on money (fractional)

Dmo = monthly discount rate on money (fractional)

Dp = monthly production decline (fractional)

EE = annual expense escalation rate (fractional)

Eex = monthly expense escalation (fractional)

EP = annual price escalation rate (fractional)

Epr = monthly price escalation (fractional)

FIXEDcost = monthly fixed operating cost (dollars)

GROSSinc = monthly gross operating income (dollars)

LIFTcost = monthly lifting costs (dollars/unit prod)

NETinc = monthly net operating income (dollars)

ORR = over riding royalty (fractional)

Pr = product price ($/unit prod)

PVtotal = present value of well (dollars)

PVwi = present value of well to working interest (dollars)

QI = initial daily production rate (units/day)

Qm = monthly production rate (units/month)

ROY = government or freehold royalty (fractional)

Rwi = return to working interest (dollars)

T = time on production (monthly)

Tcon = time at constant production rate (months)

Tec = time at economic limit (months)

WI = working interest (fractional)

COMMENTS:

COMMENTS:

Payout occurs in the month when Sum (Dcf) = DCC. This can be found

by creating a table of monthly data to see where the payout occurs.

Rate

of return on investment is the discount rate which makes SUM (Dcf)

= DCC at the economic limit of the well. This can be found by

successive iterations with different discount rates until the

equality is met.

RECOMMENDED

PARAMETERS:

RECOMMENDED

PARAMETERS:

Use local experience.

NUMERICAL

EXAMPLE:

NUMERICAL

EXAMPLE:

1. For a typical month in the life of the well, assume:

QI = 1000 bopd

Price = $30/bbl

Tc = 32 months

COP = $16000/mo

CLF = $3/bbl

Annual decline rate: D = -0.257

Annual price escalation: EP = +0.06

ORR = 0.10

Annual expense escalation: EE = + 0.08

ROY = 0.20

Annual discount rate: Dm = + 0.25

WI = 0.50

Dp

= (1 + (-0.257)) ^ (1 / 12) - 1 = -0.0245

Dpr = (1 + 0.06) ^ (1 / 12) - = +0.0049

Eex = (1 + 0.08) ^ (1 / 12) = +0.0064

Dmo = (1 + 0.25) ^ (1 / 12) - 1 = + 0.0188

For month number 36 (after constant rate has ended):

Qm = 1000 * 365 / 12 * ((1 + (-0.0245)) ^ (36 - 32)) = 27543 bopm

GROSSinc = (1 - 0.10 - 0.20) * 27543 * 30 * ((1 + 0.0049) ^ (36))

= $689,000

FIXEDcost = 16000 * ((1 + 0.0064) ^ (36)) = $20,.000

LIFTcost = 3 * 27543 * ((1 + 0.0064) ^ (36)) = $104,000

NETinc = 689000 - 20000 - 104000 = $565,000

Dcf = 565000 * ((1 - 0.0188) ^ (36)) = $285,000

Rwi = 0.50 * 285 = $142,000

It

is left to the student to find the present value, payout time,

and rate of return on the example. It is tedious work without a

computer. An example from the author’s META/LOG program is shown

below.

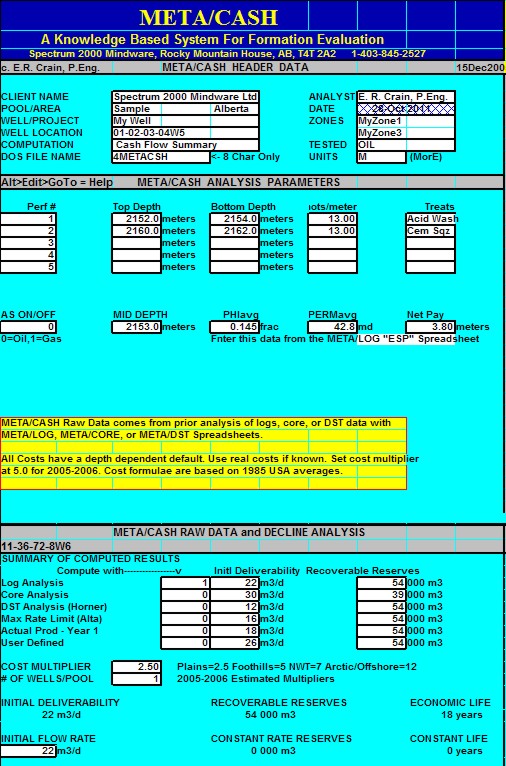

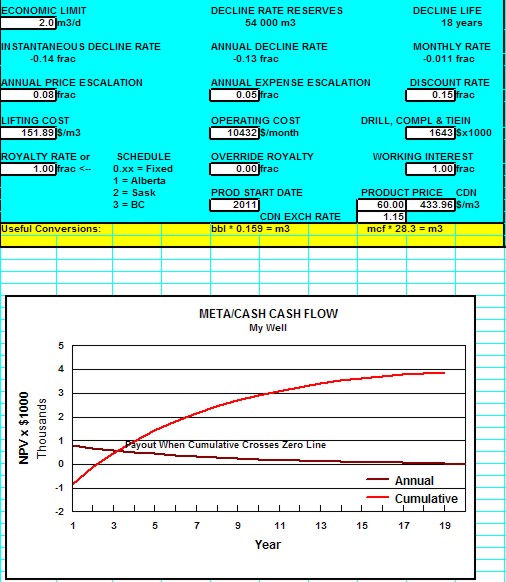

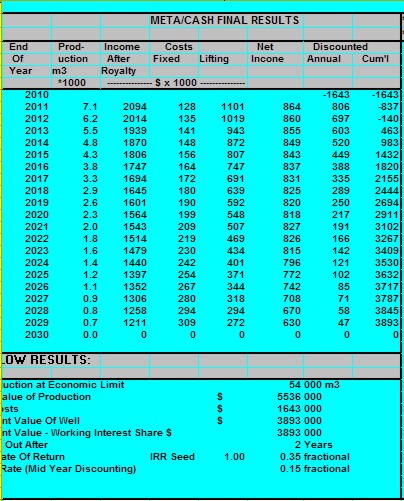

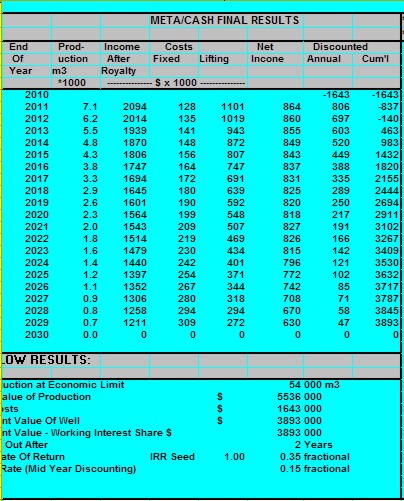

Example from production prediction and cash

flow calculation

META/LOG "CASH SPREADSHEET -- Cash Flow

META/LOG "CASH SPREADSHEET -- Cash Flow

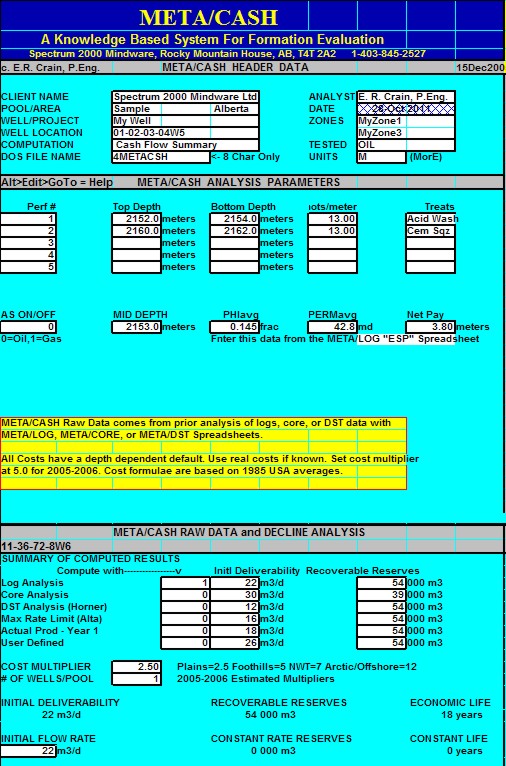

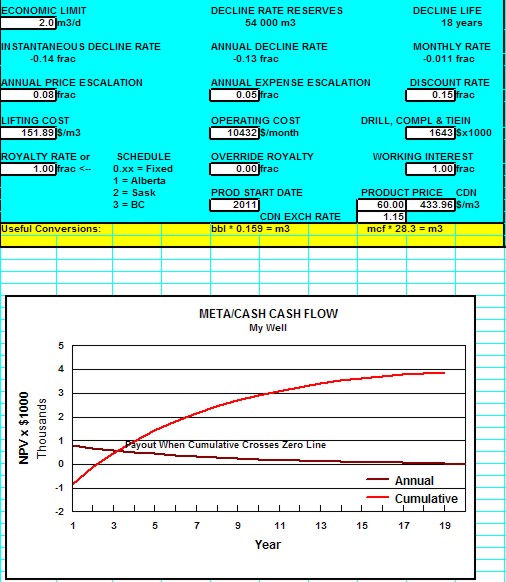

This

spreadsheet first estimates a production prediction based on

exponential decline, provides for input of costs and prices,

then generates a net cash flow analysis. Note that the defaults

for costs are obsolete.-You can use the cost multiplier to bring

them into line with today's costsm or enter your own data.

Download this speardsheet:

SPR-22 META/LOG PRODUCTION and CASH FLOW CALCULATOR

Calculate production profile,

decline curve, costs, and cash flow of a well from estimated

flow

Units.

Sample output from "META/CASH" spreadsheet

|